Customs Compliance in eCommerce

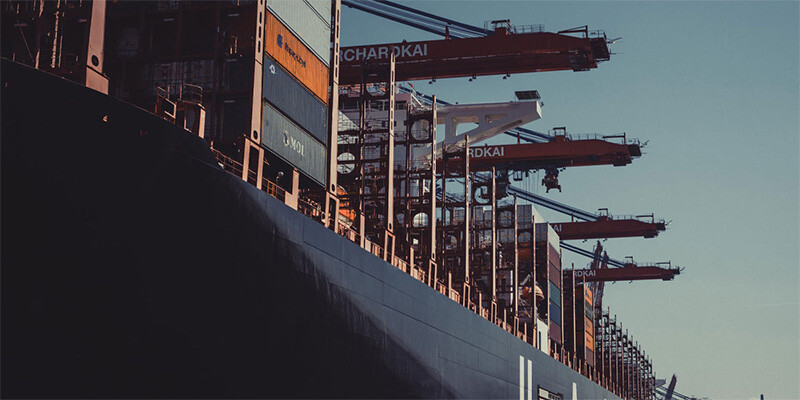

Ensuring seamless cross-border transactions through regulatory adherence

Why take this training?

Your goals

You have the objective of mastering customs compliance in the context of e-commerce to ensure that your international transactions are fully compliant with regulations.

You wish to gain a comprehensive understanding of customs requirements, procedures, and legal obligations, allowing you to efficiently manage your import and export operations.

You would like to develop the skills necessary to navigate the complexities of cross-border e-commerce, such as classification, origin, and valuation of goods, while minimizing risks and delays.

You aim to streamline your e-commerce activities by ensuring that all customs procedures are correctly handled, thus avoiding potential penalties and improving operational efficiency. The ultimate goal is to equip you with the knowledge and tools necessary to maintain smooth and compliant e-commerce transactions in an increasingly competitive international market.

Your key takeaways

- Understanding the position of e−commerce in cross−border trade.

- A deeper knowledge of the peculiarities of EU customs and VAT legislation as applied to e−commerce.

Do you want to showcase these skills with a certificate? This module is part of the:

University Certificate: Specialization in Customs

Your organization key takeways

- Ability to demonstrate compliance with tax and product regulations upon entry of e−commerce goods.

This training is organized in partnership with:

![]()

And with the support of:

What is the pedagogical approach?

Practical learning focused on e-commerce customs compliance

The pedagogical approach of this training is centered on practical learning, aimed at providing you with the tools and knowledge to manage customs compliance in the ever-evolving field of e-commerce.

Through real-life examples and practical exercises, you will gain hands-on experience in handling customs procedures, classifying goods, and understanding rules regarding the origin and valuation of products.

This approach ensures that you can immediately apply the knowledge acquired to streamline your cross-border operations and ensure full compliance with international regulations.

Interactive discussions and expert guidance

The training also emphasizes interactive discussions between participants and expert guidance from experienced trainers in the field of customs compliance.

You will have the opportunity to share experiences, address specific challenges related to your business, and benefit from personalized feedback. The expert trainers will provide you with insights into best practices and strategies for managing e-commerce customs procedures, helping you to avoid common pitfalls and improve the efficiency of your international operations.

About the Customs & Excise programs

Customs and Excise is a modular, academically oriented specialisation programme organised by the universities of Liège and Antwerp in Belgium, in collaboration with the Belgian Customs Authorities and the private sector.

The basic program introduces participants into the fundamentals of customs and excise. The advanced program comprises 11 modules and provides in−depth analysis of particular customs and excise related topics.

The universities have developed the Continuing Education Customs and Excise around the EU Customs Competency Framework. The program participates in the pilot project of the European Commission to obtain an EU Certification of Recognition as a label of excellence for customs academic programs, which is expected for 2021.

E-learning or presential

Attendance is encouraged to foster interaction. However, the course is offered in a hybrid format, allowing you to follow it live remotely with interaction. It is also recorded, enabling you to watch (or rewatch) a session at a later time.

What is the cost of this training?

Price

- 1.760€.

- The prices mentioned are exempted from VAT under Article 44 §2 4 ° of the VAT Code

Financial aid

- Possibility of using 28 training vouchers with the number: 0010-0001-0215.

- Actors in the food sector can benefit from educational leave assistance through the Alimento group. Visit the financial aid page for more information.

- Approval of paid educational leave: This program is subject to accreditation renewals for the paid educational leave system. Financial aid can be granted from 32 hours of training actually completed. Please note that the minimum hourly volume must be consumed over the academic year, and not over the calendar year. Do not hesitate to contact us to find out the terms and conditions.

- Regarding other potential aid, please refer to the dedicated page.

Payment methods

- Payment information is provided in the registration confirmation sent by email.

- Payment is made via bank transfer.

- An invoice will be sent afterward.

Who is this training for?

Target audience

- Customs professionals (public and private sector) from across the EU.

Requirements

To participate in this training, it is necessary to be certified from the course Fundamentals of Customs and Excise Legislation taken at HEC Liège Executive Education or the Antwerp Tax Academy. If you do not have this certification, it is possible to demonstrate equivalent experience in the field

Who are our experts?

Marc BOURGEOIS

Expert

Professeur ordinaire à la Faculté de droit de l'Université de Liège. Directeur du Master de spécialisation en droit fiscal de l'ULiege. Co-président du Tax Institute de l'ULiege. Co-responsable académique du Certificat en finances publiques (ULiege et UCL).

Yves MELIN

Expert

Yves Melin est licencié en droit de l’université de Liège (1999), et LLM en droit du commerce international de l’Université d’Essex (2000). Il est avocat au barreau de Bruxelles depuis 2000, et fondateur de Cassidy Levy Kent (Europe), un cabinet d'avocats spécialisé en droit du commerce international établi à Bruxelles, Ottawa et Washington. Sa pratique se concentre sur le droit du commerce international et des douanes, et sur les questions réglementaires liées à l’importation et à l’exportation de marchandises. Il est membre depuis 2018 de la Customs & Trade Law Academy de l’Université de Liège, et chargé de cours à ULiège et UAntwerpen. Il est fondateur de Greenlane.eu, une association d’avocats praticiens du droit des douanes, et de Customspliance.eu, une association co-fondée par l’université de Liège dédiée à l’échange d’expérience et l’apprentissage de la matière douanière en Belgique francophone. Il est également vice-président de CONFIAD (la confédération internationale des agents en douanes) et membre du comité de rédaction du Global Trade & Customs Journal (Kluwer).

Philippe HEEREN

Expert

Avocat spécialisé en douanes, accises et commerce international, Philippe Heeren aide ses clients à résoudre des litiges douaniers et à gérer les questions d'évaluation, de classification et d'origine. Il enseigne également le droit douanier à l'Université de Tilburg et à l'Université d'Anvers.

Eager to learn more ?

Certificat d'Université : Spécialisation en douane

Classement tarifaire, origine et valeur en douane

Les fondamentaux de la législation en douanes et accises

Présentation des formations en douane et accises

Do you have any questions?

Asmaa MOKHTARI

Secrétaire générale de la Customs & Trade Law Academy

Téléphone: +32 491 36 22 20

Adresse email: douanes@uliege.be

Je suis chargée de l'organisation et du suivi des programmes associés à mes coordonnées. Je reste à votre disposition pour toute question ou information complémentaire concernant ces programmes.